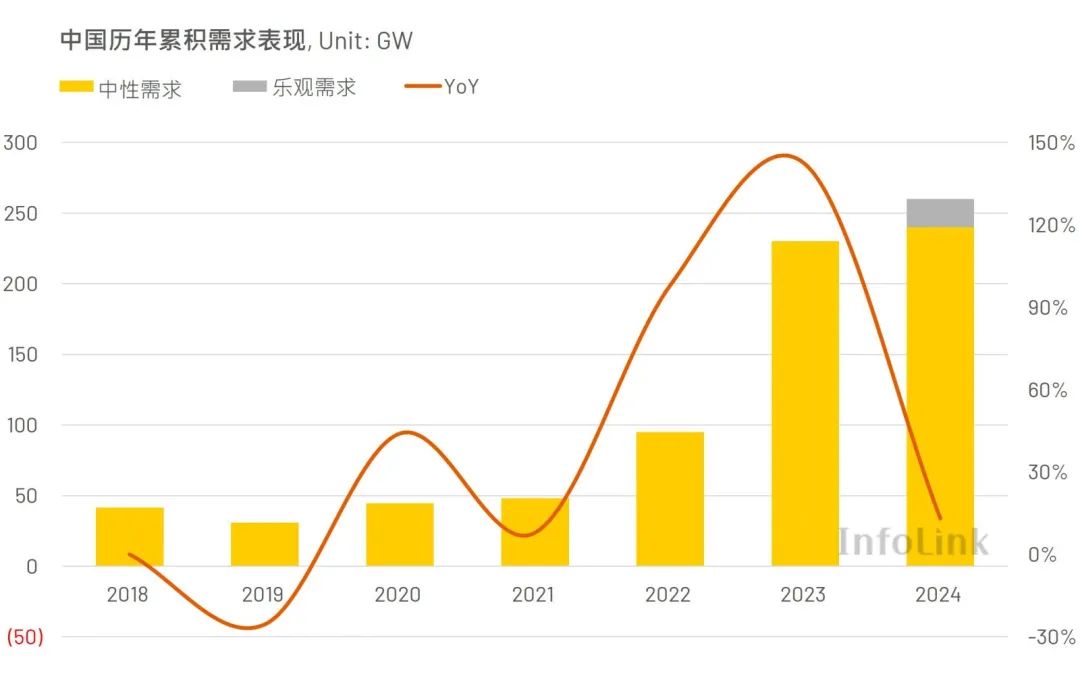

China is one of the largest photovoltaic key markets in the world. Observing the annual new installed capacity statistics from the National Energy Administration of China, since 2018, China's new photovoltaic installed capacity has shown steady growth, and even reached a historical peak of 216.3 GW of new photovoltaic installed capacity in 2023, a year-on-year increase of 147% compared to 87.4 GW in 2022, which has led to significant leapfrog growth in the Chinese market in recent years. As of April 2024, 60.1 GW of photovoltaic installed capacity has been added this year, bringing the cumulative total to 671.5 GW.

Considering the capacity ratio and module delivery status, InfoLink estimates that the module demand in the Chinese market will be 230 GW in 2023, a year-on-year increase of 142% compared to 95 GW in 2022, accounting for nearly 50% of the global overall photovoltaic demand. However, starting from 2024, the Chinese market is gradually facing issues of land compliance and ecological review, which can easily affect the development of centralized project sites. In addition, some provinces have introduced policies related to time of use electricity prices and market-oriented trading of renewable energy this year, making market-oriented trading of photovoltaic power a future trend and adding uncertainty to the demand for distributed projects. In addition, China is still facing grid congestion and feeder transportation problems, and the mismatch between supply and demand continues to exist. Overall, this has brought a certain degree of negative impact on the demand for components in the Chinese market this year, and most manufacturers are adopting a conservative and wait-and-see attitude towards this.

Despite this, the Chinese State Council released the "2024-2025 Energy Conservation and Carbon Reduction Action Plan" in May this year. In addition to lowering the original 95% new energy consumption red line to 90% and accelerating the approval process for new energy projects, it also encourages the installation of photovoltaic modules in industrial and commercial buildings, public buildings, and transportation hub facilities. Driven by China's stimulus policies, other favorable measures, and overall environmental trends, it is expected that China's photovoltaic demand will continue to grow slightly in 2024. It is estimated that China's photovoltaic demand this year will fall between 240-260 GW, although the growth rate is far lower than last year, it can still maintain a growth rate of 4-13%.

Observing the situation of various projects in China, in terms of centralized projects, due to the downward trend in component prices in 2023 driving the development of ground projects in China, the installed capacity has reached its peak in previous years. It is expected that centralized projects will mainly rely on large base projects in northwest China in 2024: there are still remnants of the first phase this year, and some of the second and third phases are also under construction, but the overall timing is uncertain. In addition, the Chinese government has recently requested to accelerate the construction of large-scale wind and solar energy storage projects, which is expected to bring relatively stable demand for centralized projects this year and next.

In terms of distributed projects, the subsidy policies of various provinces in China this year are significantly weaker compared to previous years. Currently, only the policies of cities or parts of provinces such as Beijing, Shanghai, Zhejiang, Guangdong, Jiangsu, and Anhui are still applicable to this year's subsidy applications for distributed projects. In addition, the National Development and Reform Commission issued the "Measures for the Supervision of Fully Guaranteed Acquisition of Renewable Energy Electricity" in April, which divides new energy power generation projects into guaranteed acquisition electricity and market traded electricity, making time of use electricity prices and market-oriented transactions an inevitable trend, and adding uncertainty to the market. The need to re calculate profits also affects users' installation willingness. However, the situation of industrial and commercial projects has been relatively good this year, mainly due to the sustained demand for green electricity from enterprises, coupled with policy support, which is expected to support the overall distributed demand to a certain extent. However, the overall situation still needs to continue to pay attention to the electricity prices and trading policies introduced by various provinces in the future, as well as the calculation performance of actual benefits.

In terms of special projects, recently affected by land and regulatory review and ecological conservation policies, it has been difficult to obtain land for project development, leading developers to gradually seek development space in deserts or seas. In terms of desertification control projects, there is a high degree of correlation with the Northwest Base Project. However, in some areas such as Inner Mongolia, local production products are required for field projects, and independent peak shaving and energy storage are required for self use. In addition, the development tension of desertification control projects is limited due to feeder transmission problems. Currently, the construction of ultra-high voltage has been postponed to 2026-2027, and it is expected that there will be no demand for desertification control projects this year. Some demonstration projects may begin next year. The current component products also need to consider the improvement of reliability testing such as wind and sand, so it is necessary to wait for solutions and other related measures to be perfected. In addition, offshore photovoltaics is also a special scenario for development in recent years. It is expected that there will be a demand for 2 to 3 GW of modules for China's offshore photovoltaic projects this year, mainly located in the coastal areas of Shandong, Jiangsu, Zhejiang, and Fujian. Construction will begin from July to August, but there are still uncertainties. The conditions for offshore wind and wave construction are difficult and need to wait for indicators to be issued. The overall demand volume needs to be carefully estimated, and there is potential growth space. Special fields such as desertification control and offshore areas are expected to bring incremental long-term demand.

Observing the supply and demand performance in 2024, while the demand in the Chinese market is relatively weak this year, production capacity has shown an increase. If we simultaneously observe the oversupply problem of 230 GW demand last year, with limited demand growth this year, the production capacity in various links continues to increase, and the actual withdrawal of production capacity is unclear. Analyzing this year's supply-demand mismatch problem, manufacturers should adjust their operating rates according to the actual supply and demand situation, control the actual output volume to balance supply and demand.

In terms of silicon materials, as of June this year, the inventory level of silicon materials has reached 250000 to 290000 tons (about 110-128 GW), which is equivalent to a cumulative inventory of more than 1.5 months. Although some manufacturers have planned maintenance and reduced production schedules in the hope of easing the problem of oversupply, the prisoner's effect has affected manufacturers, and actual production capacity has not significantly decreased. In addition, it takes time to prepare for the closure and maintenance of silicon material links. It is expected that the accumulation of silicon material inventory will become a normal state in the market in the future. Compared to the silicon material sector, the inventory level of silicon wafers has remained relatively healthy in recent times, with a total inventory of about 4 billion pieces. Except for two top manufacturers maintaining relatively full utilization rates, most manufacturers have experienced a significant reduction in production scheduling and are actively clearing their inventory.

On the downstream side, the battery sector generally adjusts its utilization rate in response to the component sector. Compared to the upstream supply sector, the production capacity and actual output are more in line with the components. In addition, as of June this year, there were nearly two months of inventory of components. Due to trade restrictions and policy instability, many leading manufacturers have planned to reduce production, and mid to late stage manufacturers have also experienced production cuts and revisions. Coupled with weak demand in the Chinese market this year, the situation in the component sector is relatively pessimistic.

Based on the above, although the performance of China's centralized and business distributed projects has the opportunity to provide some support for demand in 2024, it also faces land, grid congestion, and feeder transportation issues. In addition, the leapfrog growth of photovoltaic installed capacity in 2023 may to some extent compress this year's demand volume. The overall market situation is relatively weak, and the problem of mismatched demand is expected to continue to exist. In the long run, as the future market gradually becomes accustomed to trading in the new energy Libreville market, it is expected to alleviate the pessimistic sentiment of distributed projects. InfoLink currently estimates that China's demand in 2025 will fall between 258-278 GW, an increase of 7-16% year-on-year compared to this year's demand. However, the growth rate and actual volume still need to be continuously observed in the market situation and adjusted according to future market conditions.